Fibonacci levels are used a lot in technical analysis to identify buying or selling areas through the determination of supports and resistances.

They get their name from the famous Italian mathematician Leonardo Fibonacci who invented the Fibonacci sequence where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, …)

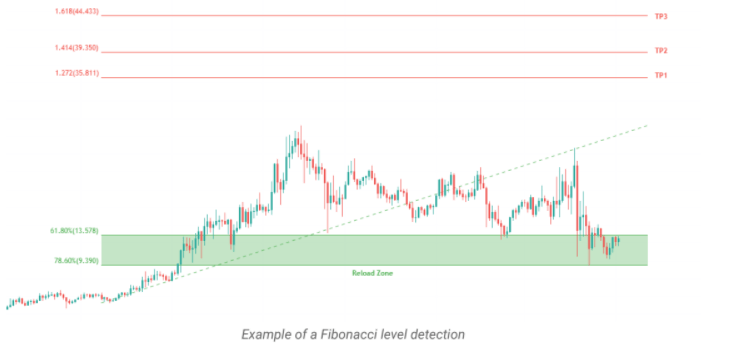

We distinguish the Fibonnaci extensions from the Fibonacci retracements, who both expres mathematical ratios of the sequence.

Famous retracement levels: 0.236 (23.6%), 0.382 (38.2%), 0.5 (50%), 0.618 (61.8%), 0.764 (76.4%), 0.886 (88.6%).

Famous extension levels : 1.272 (127%), 1.414, (141%), 1.618 (61.8%), 2 (200%) ou encore 2.618 (261%).

The indications resulting from these calculations can be exploited for short as well as long terms for trading and/or investing profiles. Note that the Fibonacci levels are even more relevant on assets followed by a large number of traders, thanks to the auto-persuasion phenomenon.