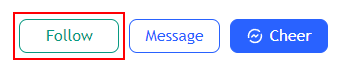

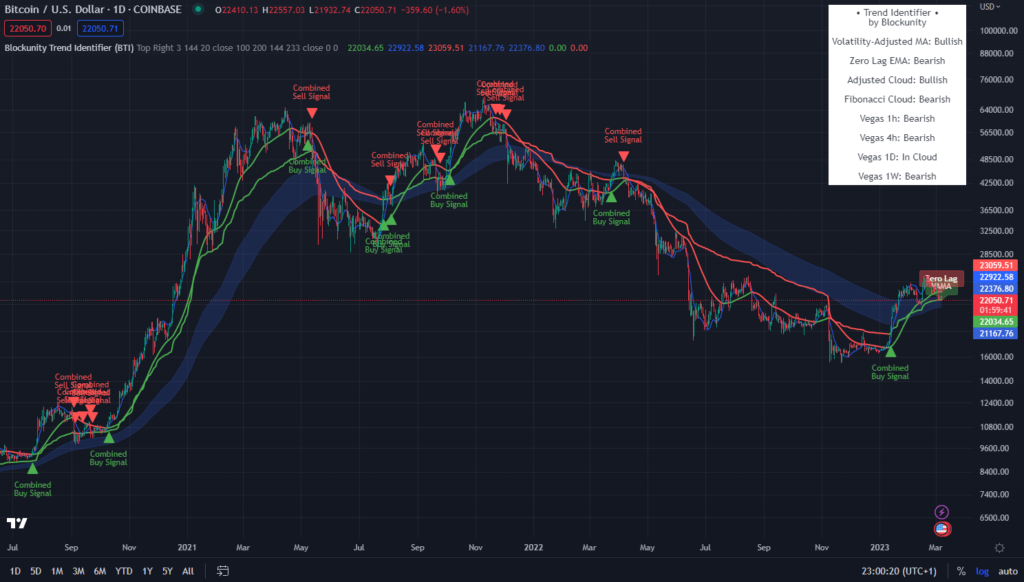

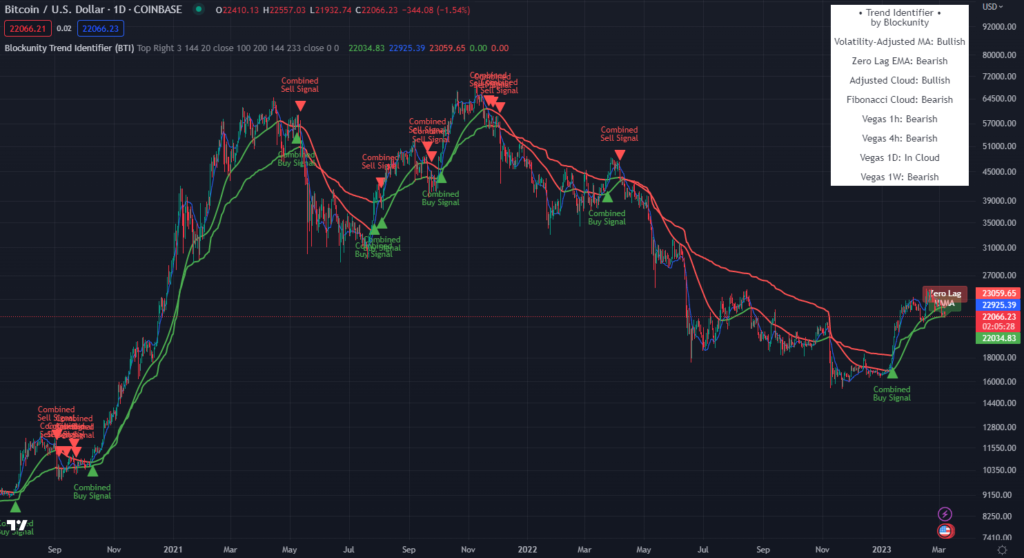

As the name implies, this indicator identifies the trend of an asset with several configurable elements, including moving averages and trend following clouds. In addition, it summarizes the status of the different trend following elements in a simple box to save time. Finally, it comes with signals to give information about potential market reversals.

Usage advice #

There are no specific guidelines for this indicator. It works on all time units and all assets. We still recommend that you use your logarithmic chart for a better visualization, but this is optional.

Avoid displaying too many elements at the same time so that the graph does not become unreadable and prefer to look at the box containing the information of the different elements directly.

The different elements #

On your chart, you can first find two moving averages:

- The Volatility-Adjusted MA (VAMA) is an evolved moving average that takes into account the volatility of the asset to better reflect the state of the market.

- The Zero Lag EMA is a moving average designed to quickly detect changes in the market in order to be aware as soon as possible of a potential interruption in the current trend.

You can then display several types of trend following clouds:

- The Adjusted Cloud is by default formed by the 100 and 200 moving averages and then adjusted by a calculation to give better results.

- Then we have the Fibonacci Cloud, a trend-following cloud calculated with the well-known Fibonacci sequence.

- Finally, it is possible to display 4 trend following clouds called Vegas, which are formed by default by the 144 and 233 moving averages. Each of these clouds is on its own time unit (1h, 4h, 1d, 1w).

The different signals #

It is also possible to display several types of signals on your chart:

- Those coming from the trend change of the Volatility-Adjusted MA.

- Zero Lag EMA tendency changes signals.

- The Filtered VAMA Signals give the trend changes of the Volatility-Adjusted MA, while filtering with the trend state of the Zero Lag EMA.

- The Combined VAMA & Zero Lag Signals also aim to apply a kind of filtering, but by combining all the signals given by these two moving averages.

Settings #

By opening the parameters of the indicator, it is possible to :

- Choose the position of the panel.

- Enable or disable the display of the above mentioned signals.

- Display and configure the parameters of the Volatility-Adjusted MA.

- Display and configure the parameters of the Zero Lag EMA.

- Display and configure the Adjusted Cloud parameters.

- Display the Fibonacci Cloud.

- Configure the parameters related to the whole Vegas.

- Display the different Vegas.

Panel information #

The panel of this indicator gives the status of all the different elements:

- Volatility-Adjusted MA: Bullish / Neutral / Bearish.

- Zero Lag EMA: Bullish / Neutral / Bearish.

- Adjusted Cloud: Bullish / In Cloud / Bearish.

- Fibonacci Cloud: Bullish / In Cloud / Bearish.

- Vegas: Bullish / In Cloud / Bearish.

The panel color does not vary for this indicator.

Indicator link #

https://www.tradingview.com/script/VO914aeV-Blockunity-Trend-Identifier-BTI/

Please click on the Boost button of our indicators!

And don’t forget to follow us on TradingView so you don’t miss any updates: https://www.tradingview.com/u/Blockunity/