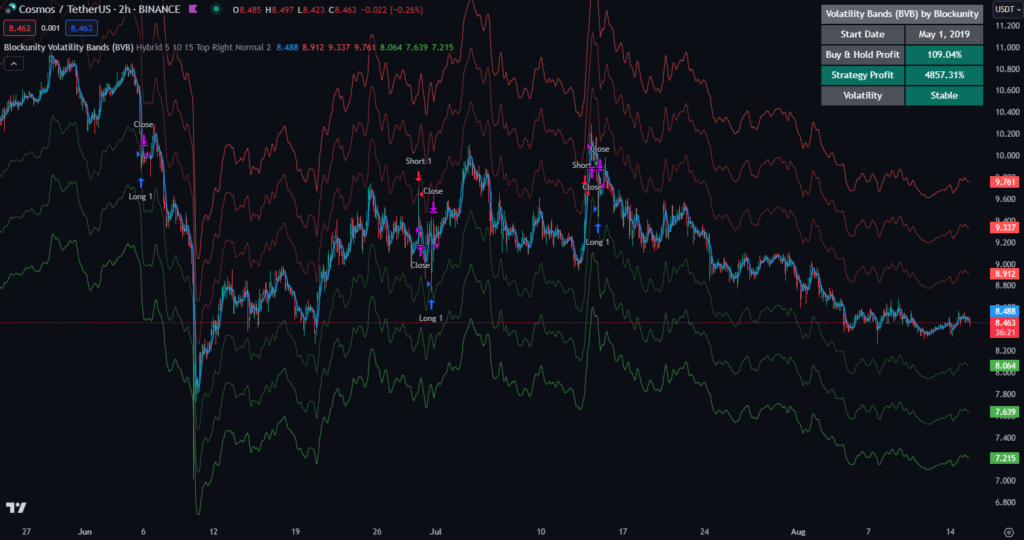

Introducing the Volatility Bands (BVB), the exceptional strategy designed to maximize profitability in the highly volatile crypto market, offering exceptional efficiency and stability. Compatible with a wide range of assets and various timeframes, BVB empowers you to capitalize on market fluctuations with confidence and precision. Unleash the potential of BVB and elevate your crypto trading to new heights of success.

Usage advice #

This strategy can be used on the following timeframes: 1H, 2H, 4H. Note that this strategy can take up to 3 successive positions in the same direction. It is recommended to use your chart in logarithmic scale.

The different elements and signals #

- First, you’ll find a central moving average. Reference point for assessing the trend and obtaining triggers. Positions are closed when the price returns to this line.

- Secondly, you’ll find trigger lines, which are extensions of the central moving average. 3 above and 3 below. These lines are there to detect buying and selling opportunities, and trigger position-taking.

- Finally, we find the trading arrows/signals on the chart. They allow you to apply the strategy described above, by opening long and short positions, as well as closing these positions. The blue arrows indicate the opening of a Long (buy) position, while the red arrows indicate the opening of a Short (sell) position. The purple arrows indicate the closing of the positions.

Settings #

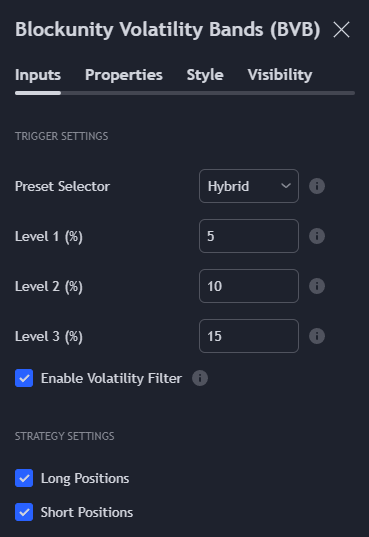

By opening the parameters of the indicator, you get the following items:

- Preset Selector: It lets you modify trigger lines without touching level values, to suit your profile. Hybrid mode is the default, and takes the values indicated above to define the levels. Aggressive mode halves all levels, and Conservative mode doubles them.

- Configuration of the 3 levels of trigger lines: This makes it possible to vary the amplitude of position-taking levels, and can be useful for adapting to the volatility of a specific asset.

- Enable Volatility Filter: This option, which is activated by default, filters signals according to volatility criteria, in order to eliminate certain positions that may be considered too premature or risky.

- Long/Short Positions: Both parameters are enabled by default. Unchecking them will respectively disable Long and Short positions.

- Table Settings: All these parameters allow you to customize the data table to your personal preferences.

Panel information #

Like all Blockunity indicators and strategies, we find a table that gives several information:

- Start Date: Indicates the start date of the strategy backtest and the period taken into account for the two statistics below.

- Buy & Hold Profit: Gives the return percentage for a position that does not follow the strategy’s signals, having been bought at the very beginning and held until today.

- Strategy Profit: Returns the percentage of strategy execution.

- Volatility: Indicates whether the asset’s volatility is considered reliable (Stable) or too risky (Too High). This parameter is taken into account when taking positions if the “Volatility Filter” setting is activated.

Indicator link #

https://www.tradingview.com/script/ZSMwb9Rj-Blockunity-Volatility-Bands-BVB/

Please click on the Boost button of our indicators!

And don’t forget to follow us on TradingView so you don’t miss any updates: https://www.tradingview.com/u/Blockunity/